You may be surprised to learn that the worst culprits for consistent late payment are not actually the massive corporate juggernauts or the mini mom-and-pop businesses out there… the latest payers are actually high street retailers.

Market Invoice, a peer-to-peer platform for selling invoices online, recently published a report about the state of late payment of invoices across business sectors in the UK and beyond. Data was gathered from more than 30,000 invoices over 5 years from 80 countries.

Retailers letting the side down

The company found that of all business types in the UK, high street retailers are the latest payers, paying invoices an average of 14 days late. And it may come as a surprise that banks get a gold star for paying only 0.3 days late on average. Well done banks!

This points to a systemic, underlying tendency of the largest retailers in the UK to pay their suppliers late. While supermarkets are often lambasted for taking their time, Market Invoice’s data found that high street retail stores pay on average 7 days later.

Market Invoice points out that:

“In sectors such as retail, the prominence of late payment is so extreme and so consistent that one has to assume it is by design.”

The growing demand from consumers for cheaper goods may result in further squeezing of suppliers, who have increasingly tight margins.

International late payment

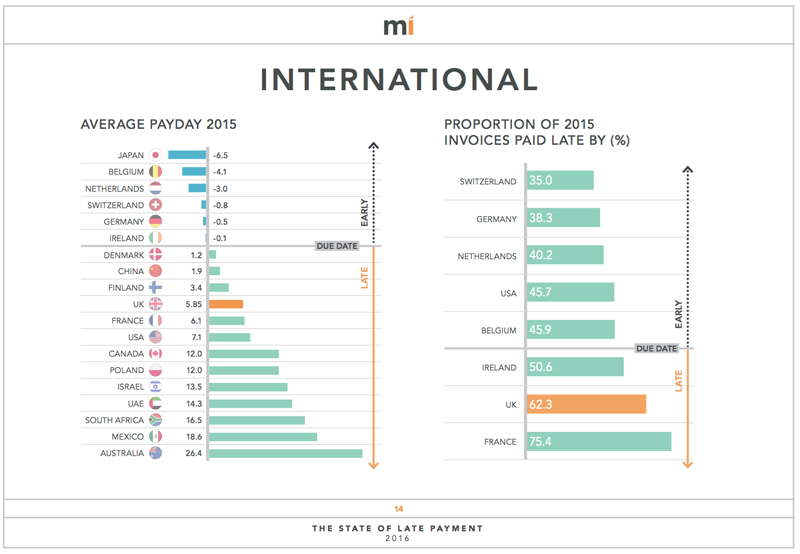

Market Invoice also took a look at the late payment habits of countries outside of the UK, and found that Japan on average pays invoices a whopping 6.5 days early, while Australian businesses pay up a cringe-worthy 26.4 days late.

Have a look at this graphic from the report:

This shows that within the EU, late payment is very much a British problem. Other European countries including Switzerland, Germany, Belgium and the Netherlands have a much better payment track record.

Late payment is terrible for SMEs (and cash flow)

It’s really pretty simple – when you are not paid on time, this can have a huge impact on your business, especially your cash flow. Those most at risk are small and medium businesses, who make up 99% of all UK businesses.

It’s estimated that SMEs in the UK are owed more than half a trillion pounds in overdue invoices.

Larger businesses, who hold the power in their relationships with suppliers, must take more responsibility and improve these harmful conditions for UK businesses.

Holding onto cash for as long as possible

What about when it comes to paying your suppliers? Doesn’t conventional wisdom tell us that we should take as long as possible to pay our bills in order to maximise cash flow?

Well…yes…but it’s a bit more complicated than that.

Pros: Obviously the later you can pay your bills, the more cash you have for longer. You can use that cash as working capital which is a measure of how healthy and efficient a business is. By managing your working capital well, you put your business in a great position for growth and/or profitability.

Cons: Sure, you might get to keep more cash in the bank for a few more days but you need to think long term. How good do you think your supplier relations will become if you continually disregard the terms you agreed? While in pure financial terms holding onto cash for as long as possible makes sense, pissing off your suppliers does not.

Solution: You should always negotiate hard when it comes to credit terms. Keep them as short as you can when selling, and get them as long as you can when buying. The important thing is to get the best deal possible and then stick to your agreement. That way your business not only benefits from great working capital but also benefits from an enhanced reputation as a good company to work with.