Rather, now it’s time to spill some ink and get some results with a deftly worded debtor collection letter; the perfect next step when the message about that overdue payment just isn’t getting through.

Before you put poison pen to paper however, take a look at the below tips to make sure you’re getting the best odds of success for your efforts, and not burning any precious economic bridges along the way.

Write a letter

‘You’ll catch more flies with honey than vinegar’ was my mother’s rule (one she rarely observed herself) nevertheless, it’s great advice.

Though you may be feeling frustrated, unfairly treated and maybe even a little cheated, bear in mind that the purpose of an outstanding invoice letter is to actually get paid, not vent your spleen, so a little civility can go a long way in these early stages (besides, there may still be the opportunity for cursing and the sweaty-fist-shaking later).

Use your ‘dear’s, ‘please’s, ‘thank-you’s and ‘kindly’s liberally; personalise the letter as much as you can, and make sure your message has all the information the customer needs to actually pay the outstanding invoice (your bank details, the amount owed etc etc).

That’s not to say you should be obsequious. To the contrary, if anything, you should err on the side of being too officious, rather than too casual. This is, after all, your money. Just keep it polite.

Write another letter

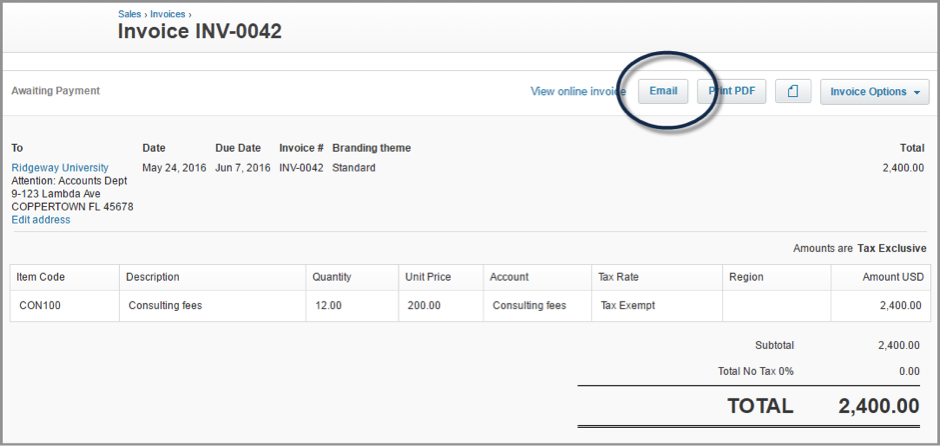

If, after a week, the above polite nudge hasn’t secured a result, it’s time to tighten the screw by a degree and be a little more direct. Include a copy of the original receipt, send it by both email and registered post and state explicitly (though still politely) that your patience is running out and, you know, debt collectors are scary.

This is still the time to be polite, but impatiently so, if such a thing exists.

Let us write a letter

Still not getting a response? It’s time to crank things up to the highest gear. Here’s a free, no-nonsense past due invoice letter template that you can use to demand that payment in no uncertain terms, while still not quite souring the relationship once and for all. It’s not rude, per se, but it states the situation in no uncertain terms.

Get it here: http://www.debtorletter.com/

Don’t write a letter at all

If you’ve exhausted the above avenues and still haven’t got paid, it might be time to do a little soul searching. Is this actually all your fault? Could this problem have been avoided all together? Could you have managed this account a little better and made sure those outstanding invoices were simply paid in the first place?

If we’re honest here, the answer is probably yes.

“But I’m busy,” you might be saying, “I haven’t got time to chase every single invoice that i send out”.

Well, it may feel like that, but that is, in fact, simply not the case.

These days you can automate those invoice chasing messages easily and cheaply, and cut the amount of time you spend following up outstanding invoices by several hours a week.

Debtor Daddy is one example — an automated software solution that politely and persistently follows up on your unpaid invoices on your behalf with skillfully-written email reminders that are proven to get results (on average, it only takes two email reminders from Debtor Daddy until an overdue invoice is paid).

For the price of a cup of coffee a week, you can shear hours off your outstanding invoice follow-up procedures and even better, you’ll actually get paid. (Take a free two week trial of Debtor Daddy here).

Got any other hacks for getting those outstanding invoices paid? — let us know — and for more information on your many lines of defence for late invoice payments, read this.